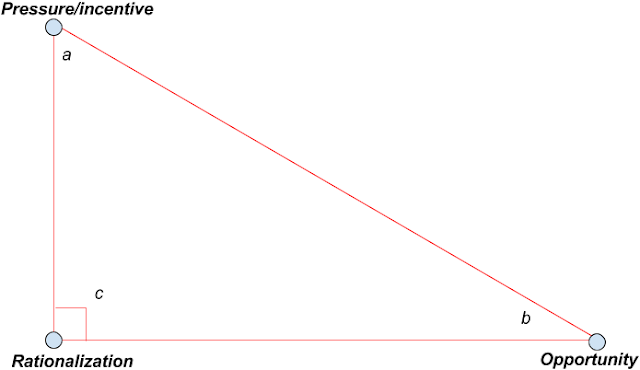

The Fraud Triangle is a theory that explains what three things need to exist for fraud to occur. You can use this information to analyse situations and lower your risks for fraud.

Here are some examples:

A∠ Pressure / Incentive - Someone having personal financial hardship can potentially be under pressure to find money. This can sometimes lead to fraud and maybe they're in a position where it is possible for them too easily skim money off of company in one way or another.

B∠ Opportunity - Someone who has a job that no one else in the company knows how to do, or they have too much approval rights and set up vendors and pay them.

C∠ Rationalization - When the person committing the fraud really believes that money is due to them because the company isn't paying them what they deserve.

Q & A:

1) Do you think one of these points is more important than the other?2) What other situations can you think of that lead to fraud?

Robert Ruhno

Director of Social Media

Accounts Payable Professionals group