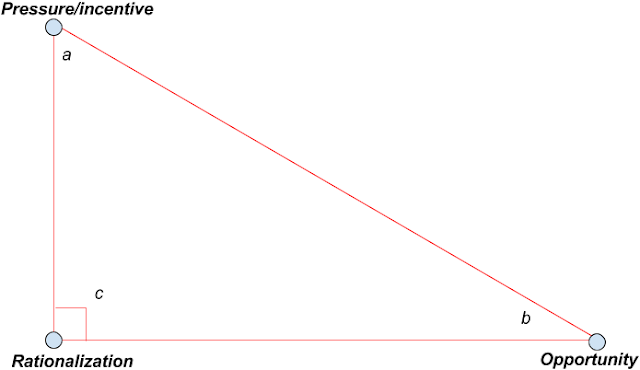

The Fraud Triangle is a theory that explains what three things need to exist for fraud to occur. You can use this information to analyse situations and lower your risks for fraud.

Here are some examples:

A∠ Pressure / Incentive - Someone having personal financial hardship can potentially be under pressure to find money. This can sometimes lead to fraud and maybe they're in a position where it is possible for them too easily skim money off of company in one way or another.

B∠ Opportunity - Someone who has a job that no one else in the company knows how to do, or they have too much approval rights and set up vendors and pay them.

C∠ Rationalization - When the person committing the fraud really believes that money is due to them because the company isn't paying them what they deserve.

Q & A:

1) Do you think one of these points is more important than the other?2) What other situations can you think of that lead to fraud?

Robert Ruhno

Director of Social Media

Accounts Payable Professionals group

There can be other aspects too which may lead to fraud.

ReplyDeleteIt actually varies from place to place and country to country.

Well, all of the above points seem major points to commit a fraud.

Yes I do agree with the above points and major factors for a fraud in an organization

ReplyDeleteSure, if there is no separation of duties in the AP Dept.(i.e. same person can print check, do reprint, purge audit trail) or user activity reports tracking attempts to access unauthorized areas of MICR and ePayments Software...then that is a large Opportunity. And hence needs less Pressure/Incentive to Rationalize committing fraud.

ReplyDeleteRegarding points A and C, I agree with Punit that varies from place to place and country to country. But I definitely give a point to Claude about the B. Segregation of Duties in AP is the most important thing to avoid Fraud. Someone in charge for invoice registration, another one for treatment and payment proposal, control and execution assigned to someone else, and approval to high level

ReplyDeleteMight be a bunch of people and surely that some AP are not that big to have this segregation but implementing control or approval in some level of duty might help

I agree with the general concept. The key issue is however, how controllable are the key element. There is also the factor of awareness. If the corporate culture does not make employees aware of the potential fraud factors, exposure can go unchecked. Training is crucial to eliminate the lack of awareness threat

ReplyDelete